Planning and saving money go hand in hand. That’s a critical financial concept for your kids to appreciate.

Here’s a simple recipe to drive the point home with the kids.

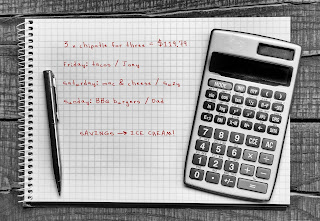

- Sit down with your kids and calculate what it costs to go out to dinner as a family at your favorite go-to-in-a-pinch restaurant. Maybe you have a recent receipt handy that you can use for the figure.

- Now, make a list with your kids of 1 to 3 simple home cooked meals. Given school obligations, it might make the most sense to target Friday, Saturday, and Sunday. Make sure each kid is in charge of at least one meal.

- Find recipes and fill out the shopping list together.

- Go to the grocery store together. Have the kids find the ingredients for their own meals. Bonus points: show them what unit prices are and how to use them for comparison shopping.

- Compare the grocery bill to the total in step 1 multiplied by the number of meals. Cheaper? Should be! Bonus points: split the savings between the kids as a reward or use the savings for a family ice cream outing.

- Cook, eat, and clean together each night. Bonus points: consider expressing gratitude together before each meal.

Give yourself a hand! You’ve taught your kids the financial power of planning ahead through firsthand experience. You’ve probably also taught them a bit about comparison shopping, how to cook a meal, the power of gratitude, and perhaps even a little appreciation for your nightly efforts.

That’s a pretty full menu of life skills packed into a few simple meals.