For many kids, money can be a bit too easy come, easy go — especially in today’s digital world.

But tracking and categorizing money thoughtfully will always be a key life skill. Dollars deserve a purpose whether digital or not. So how do we get our kids to be more mindful of money as it ebbs and flows?

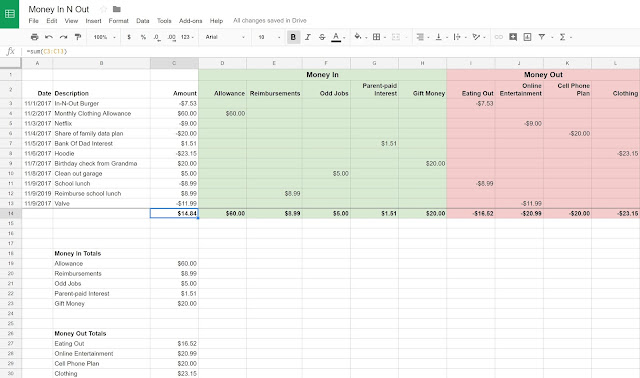

Build a Money In ’N Out Spreadsheet with your child. It’s a simple tool for pinpointing the sources for money coming in and the purposes for money going out.

Here’s a recipe I used with my son in college:

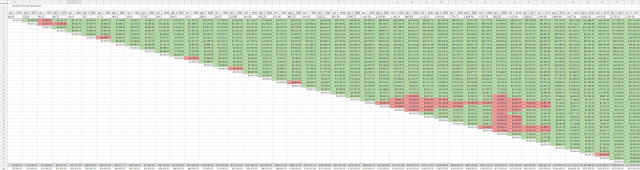

- Import last month’s transactions. Most prepaid cards or bank cards have a way to export transactions, so this step is often just a quick cut and paste. If your teen uses cash, then have her manually enter every transaction in the spreadsheet for the current month.

- Add “Money In” columns. Sit down together and figure out the main types of income. Create columns for each. In our case, money coming in was either:

- a “stipend” from dad,

- reimbursements I’ve agreed to make for certain types of purchases,

- aggressive parent-paid interest to encourage my son not to spend, and

- money from my son’s summer job savings.

- Add “Money Out” columns. For money coming out, let you child suggest the key categories of spending as you browse the transactions together. Less is more here, so steer it toward high level groupings. We ended up with:

- eating out,

- eating in,

- health,

- gaming, and

- phone.

- Copy the transaction amount into the right in or out column. For each transaction row, copy the amount into the appropriate income or spending column. In rare cases, you may need to split the amount between spending columns. But if you’re doing that a lot, your categories are probably too granular. Keep it simple — like the In-N-Out menu.

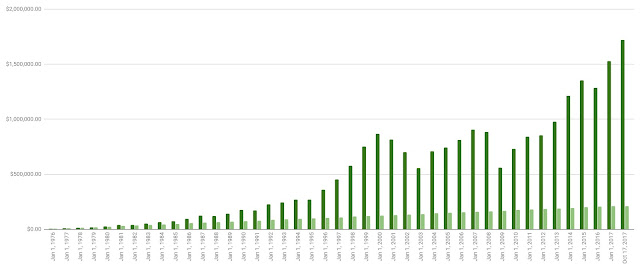

- Sum up the totals. Add a final row that sums up the amount column, the income columns, and the spending columns. The sum of the amount column will indicate the net change for the month. If it’s negative, more was spent than earned during the period.

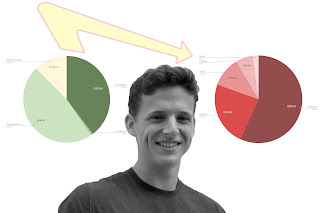

- Make in ’n out pie charts. Create an “in” pie chart for the income totals, and an “out” pie chart for the spending totals. Any surprises?

- Have a non-judgmental discussion. Here’s where you want to be long on listening and short on lecturing. Let your child make the observations. Offer constructive alternatives, like maybe a parent bounty for taking a bag lunch instead of eating out.

I created a Money In N Out spreadsheet template in Google Docs that you can copy and adjust to your liking. Check it out here.

Try the exercise with your teen, and see if it takes the money coming and going in a more mindful direction.

Like this tip? Get the next one in your inbox by subscribing here.

Want to turn these tips into action? Check out FamZoo.com.