Resolve to teach your kids personal finance skills in the New Year!

Not sure where to start? Pick a few tips from this top-ten list.

My 10 most viewed family finance tips from the last 12 months are:

10. Offer Kids A Savings Match With Strings Attached

Encourage your kid to save by offering a matching contribution, but attach some of these strings to send the right message.

9. Pre-Negotiate Your Teen’s Summer Paycheck Savings Split

Agree on this summer paycheck strategy to teach your teen the Warren Buffett saving rule. Instill a smart payroll deduction habit early.

8. Review 529 Statements With Your Teen Every Quarter

Here are 6 valuable lessons your teen can learn from 529 statements if you’re willing to make a 15 minute investment every 3 months. See if you’re up for the challenge.

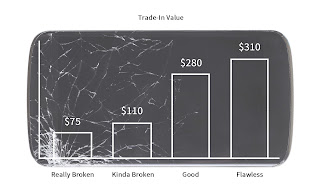

7. Motivate Kids To Maintain Value With A Trade-In Deal

Don’t want your kids being cavalier about their possessions? Try this trade-in value trick.

6. Replace Chore Charts With Money Requests

Help your kid get from dog-eat-dog to top dog in tomorrow’s work world with this proactive alternative to chore charts and allowance.

5. Fully Fund Your Working Teen’s Roth IRA

Here’s why it makes sense to max out your working teen’s Roth IRA, even if they already blew through all their paychecks.

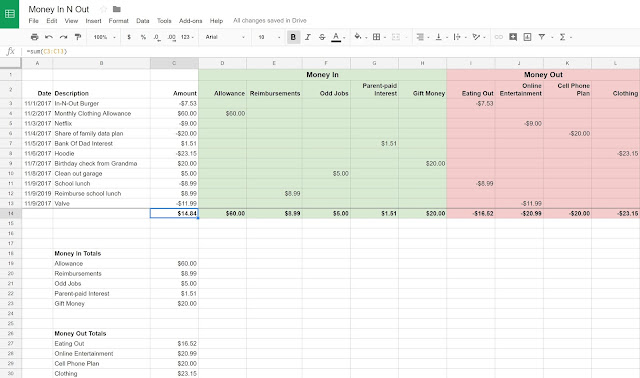

4. Clean Up Your Kid’s Spotty Bill Payment Record

Can your kid handle making consistent monthly payments for an online subscription like Spotify? FamZoo data says many can’t. Here’s why it’s time to make your kid face the music.

3. Post Wants On The Fridge To Chill Your Child’s Spending

Here’s a clever parenting trick for putting a chill on impulse spending by kids.

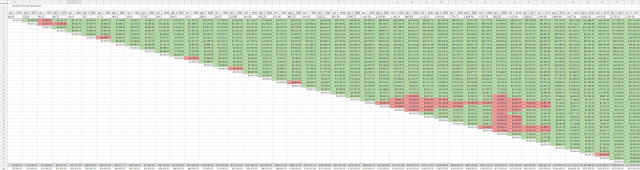

2. Show Teens The Top Of the Stock Market

Try this fun visual prop for teaching your teen some important investing wisdom: timing the stock market is a fool’s errand.

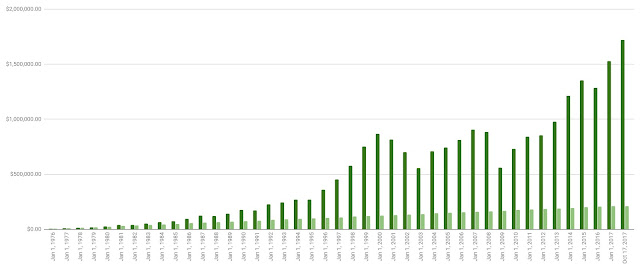

1. Show Kids What The S&P 500 Looks Like

Kids hear about stock indexes in the headlines all the time — the Dow is down, the S&P is up, the NASDAQ is flat. But do they have any idea what an index is? Here’s an easy, fun way to show them the what and why.

See any that fit your family?

Pick even just one, and you’ll have a quick victory to claim on your New Year’s resolutions. Better yet, you’ll make a lasting impact on your child’s financial future.

Happy New Year!

Like this tip? Get the next one in your inbox by subscribing here.

Want to turn these tips into action? Check out FamZoo.com.