My longest market losing streak since high school is pretty epic.

If I had invested $5,000 in the S&P 500 on January 1, 2000, it would have been worth less than that for 12 years in a row. Ouch.

But, as Tom Petty said, “Even the losers get lucky sometimes.” Especially if they wait long enough in the market. By October 2017, that original $5,000 investment would have turned into $8,976.49. Not too shabby!

But, remember, Tom also said, “The waiting is the hardest part.”

Here’s a simple spreadsheet exercise you can use to convince your teens (or your spouse or even yourself) to invest patiently in the market — even when the going gets tough.

Plot your hypothetical market winning and losing streaks dating all the way back to high school.

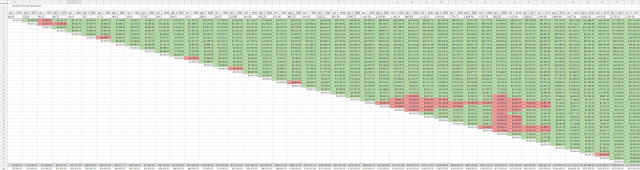

My spreadsheet shows what would happen to an investment in the S&P 500 from a given year til now for every year since my freshman year in high school. That was 1976 in case you were wondering.

This is one of those rare times where the older you are, the better it gets. So, if you’re a young parent, you may want to use grandpa or grandma as a reference point instead.

Here’s how to make a spreadsheet like mine in Google Docs:

- Find a source of historical S&P 500 data. I found mine here at multpl.com.

- Add a price column for every year since the beginning of high school. Pro tip: I was able to do this very quickly by copying the data table entries on multpl.com from the top down to the 1976 entry, pasting them vertically into a temporary sheet, sorting the data by date descending, selecting the sorted data, creating a new sheet, and using Edit > Paste Special > Paste Transposed to lay out the data horizontally across the sheet. Beats the heck out of typing!

- Define an annual contribution. Insert a couple rows up at the top, enter an amount for your fixed annual contribution size, and use Data > Named Ranges... to assign the amount to a name (like “contrib”). Then you can use that name in your formulas.

- Enter rows representing the investment performance for each year. Find the column for the starting year, and enter the initial contribution amount as the formula “=contrib”.

Fill out the remaining columns with the formula that calculates the value of the investment a year later by using the historical price data up above. My price data is in row 4, so the formula for the first anniversary of my initial investment in cell B5 looks like: “=A5+((B$4-A$4)/A$4)*A5”.

The cool thing is I can now just select that cell along with all the cells to its right and type Control-r to copy the formula across the row. Now I’ll see the value of the initial investment each year from inception to present day.

I repeat this for each successive row starting one column over to the right each time until I get to the current year. At the end, it looks like an upside down ramp.

- Add conditional formatting to call out winning and losing years. A winning year is when the current cell’s value is greater than the initial contribution. Make those cells green. Otherwise, make the cell red to mark a losing year. You can create the conditional formatting rules from the Format > Conditional formatting... menu entry.

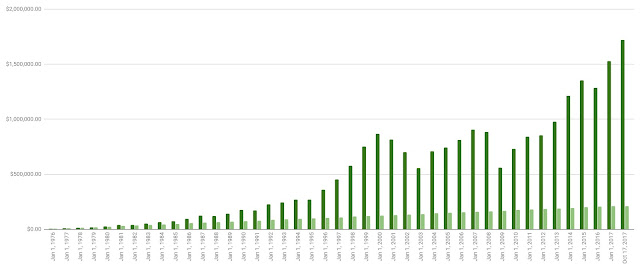

- Add running totals across the bottom. Summing the rows for each column will give the total value of all investments for each year across the bottom. I like to compare that with what would happen if I had just kept the contributions in cash the whole time.

Check out my win/loss plot.

Step back and admire all that green. It dominates. And, at the moment, there isn’t a single row that hasn’t turned green ultimately.

At the bottom right, compare the total ending value of the investments versus just stashing the same contribution in cash year after year. In my case: $1,719,627.25 vs $210,000.00.

Wow.

By the way, I’m ignoring dividends and expenses to keep things simple. With or without them, the point remains loud and clear: Dollar cost averaging plus low cost index funds for the win!

Despite an occasional epic losing streak, your simple market win/loss spreadsheet will prove to your kids that patient, consistent investing kicks cash’s backside over the long run.

All the more reason to start your teen’s Family 401(k) asap!

Like this tip? Get the next one in your inbox by subscribing here.

Want to turn these tips into action? Check out FamZoo.com.

No comments:

Post a Comment