Kids pay money to play online games.

But you already knew that. You recognize the names in their transaction alerts: EA, Minecraft, Roblox, Steam, Blizzard, Riot Games, XBox, G2A.

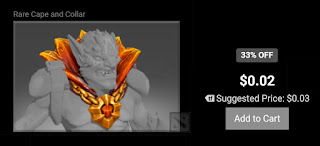

Kids also pay money to buy tchotchkies for their gaming avatars — skins, potions, weapons.

You may already know that too. If not, check out sites like realmstock.com — a marketplace for trading in-game items.

But did you know kids are even paying money to watch other kids play online games?

Yep, that’s a thing. Check out Twitch. Find a live streamer. Look for the subscribe button (probably upper right), and check out the options. Kids pay to get badges, emoticons, ad-free viewing, and other “benefits”.

In fact, one 14 year old FamZoo cardholder paid a total of $134.97 in the last 30 days watching other gamers game. Yikes.

Why do I know this? A Monday article piqued my interest in what kids are spending on gaming these days. The Wall Street Journal reported that gaming providers like EA are charging less for the games themselves while reaping huge profits from the little microtransactions inside the games.

And just how much are gamers spending on in-game microtransactions? A mind-blowing $71 Billion worldwide in 2016. That rivals the entire GDP of Cuba!

The article prompted me to dig into the FamZoo data around gaming related transactions by our child cardholders. That’s what alerted me to the Twitch trend mentioned above.

Some other discoveries:

- The average spending in the last 30 days by teen gamers using FamZoo cards is $27.41.

- The most spent in that same period was $262.09 by a 16 year old.

- Some kids pay money to play chess online. Yes, that was my favorite discovery.

Obviously, gaming companies smell a profit opportunity with our kids.

Me? I smell a financial literacy opportunity.

Try this with your young gamer:

- Review the gaming related transactions over the last month.

- Agree on a monthly gaming budget. Use the data from step 1 as a point of reference, but not necessarily a benchmark — note the average monthly teen spending mentioned above.

- Track spending versus the budget each month. As they say, “What gets measured gets managed.”

You might even consider a separate prepaid card dedicated to online gaming. Load it each month with the agreed-upon budget. Any attempts to overspend will be harmlessly declined.

So, whether your kid is paying for games, paying for do-dads inside games, paying other gamers to game, or all of the above, you need to get your head in the game as a parent. Know what your kid is doing. Then, use your kid’s gaming habit as an opportunity to pass along some critical personal finance basics.

Like this tip? Get the next one in your inbox by subscribing here.

Want to turn these tips into action? Check out FamZoo.com.

No comments:

Post a Comment