“You can run into debt, but your have to crawl out.”

~American Proverb

Your teen just got that first credit card. Here’s the conversation you want to head off at the pass.

“Dad, I went a little crazy this month with that phone upgrade. I owe $500 on my credit card bill. Fortunately, I see I can just make a minimum payment of $20. Phew!!!”

No, not phew. More like pee-YOO. As in: that debt is gonna stink big time.

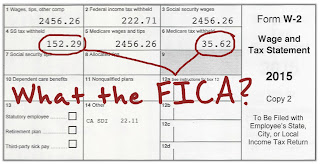

Ask your teen to guess how long it would take to pay off a $500 balance making just the minimum payments each month. Assume typical credit card terms. Let’s say 18.9% interest rate and 4% minimum payment.

The answer? Wait for it...

3 years and 8 months.

Oof. That’s almost as long as your teen will be in college. (Well, hopefully).

What if your teen paid a steady $20 every month instead of the minimum balance every time?

2 years and 9 months. Better, but still a crazy long time to a teen.

Of course, that assumes every other additional purchase on the card is fully paid off each cycle. Every. Single. One. Toss in a few unpaid purchases each month, and your teen will find credit card debt is a constant smelly companion.

That’s exactly how the story plays out. Time after time.

Change the story. Coach your teens to never make credit card purchases they can’t pay off at the end of the month. In full. When that credit card bill arrives, always pay as much as possible as soon as possible.

To make the message memorable, use this online calculator with your teen. Play with some scenarios. Have your teen plug in the price for an expensive item that’s all the rage. Check off the minimum payments option. Watch the chart expand. Minimum payment equals maximum damage.

Your teen needs to know credit card debt stinks. And the smell lingers. Fortunately, armed with your minimum payment lesson, your teen’s credit history will wind up smelling like a rose.