Today’s fantastic family finance article is:

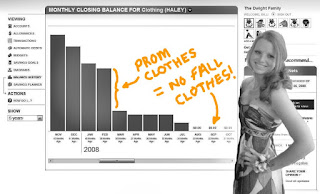

A Teen Clothing Allowance

What if you could teach your teen a critical financial skill while reducing emotional conflict along the way? To any embattled teen parent, that sounds about as magical as cold-fusion, but read on for the recipe.

Pick an area of spending that your teen is particularly passionate about. Clothing is a classic choice. It’s well defined. It’s a basic need that regularly balloons into “want” territory. It’s subject to loads of impulsive decision making and peer pressure. It’s a classic emotional friction point between parents and teens.

Tell your teen:

“You will have a dedicated expense account for spending in this area.”

“You will be in complete control of the spending decisions.”

“To receive your funds in the account, you must propose a budget that we will review, revise, and agree upon together.”

“You can receive the funds up front in one lump sum, or monthly in installments. Your choice.”

“You will not receive any additional funds above and beyond the budget. When the money’s gone, it’s gone. Period.”

“You can keep any money left over if you come in under budget.”

Check out today’s article for some excellent additional tips.

Where’s the conflict reduction part you ask? Note all the “you” and “yours” language above. It turns out teens crave responsibility. If they own the budget and the decision making, they’ll own the consequences too. Without argument.

It’s called skin in the game. Try it. It’s magic.

Get tomorrow’s tip here.

No comments:

Post a Comment