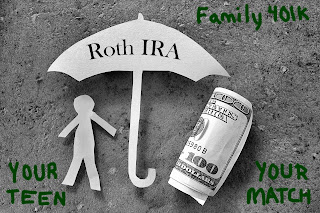

Dan Kadlec reports that Fidelity has finally joined others in providing custodial Roth IRA accounts for kids under 18. Bravo. Let’s hope that prods parents to make one of the smartest financial moves possible for their working teens: setting up a “Family 401k.”

If your teen made some W-2 income at a part-time or summer job last year, here’s the quick recipe:

- Open up a Roth IRA (as a custodial account if your teen is under 18).

- Convince your teen to contribute some of those summer earnings to the Roth. Already spent? How about that tax refund? (Hint: sit down together with an online compound interest calculator. The power of compounding over 50 years is an eye-opener for even the most jaded teen!)

- Match your teen’s contribution if you can, ideally up to the limit.

- Invest the money in a low cost, broadly diversified index fund.

- Repeat starting at step 2 next year! (Bonus discussion: dollar cost averaging.)

Dan explains in more detail.

P.S. Consult your financial advisor first.

No comments:

Post a Comment