Here’s a simple story to share with your kids about saving and investing.

Once upon a time, Noah, Chloe, Quincy, and Lyla were all buddies who graduated from college together 40 years ago.

Noah decided to start saving right away at age 25 and saved $10,000 every year for 40 years until his current age of 65. He kept his savings safe at his local bank.

Chloe talked to Noah and did exactly the same thing for 40 years. But after talking to her parents one weekend about the stock market, she decided to invest her $10,000 every year in a low cost index fund instead of leaving her savings in the bank.

Quincy talked to Chloe and decided to follow her approach too. Unfortunately, after 10 years, Quincy couldn’t come up with the $10,000 any more to save and invest, so he did nothing more for the remaining 30 years.

Lyla came to the party late. She missed out on all the saving and investing chatter and didn’t do either for the first 10 years. Finally, at age 35, she talked to Chloe and copied her saving and investing plan for the remaining 30 years.

So, in summary:

- Noah saved for 40 years keeping the money at the local bank.

- Chloe invested for 40 years.

- Quincy invested for 10 years and then did nothing for 30 years.

- Lyla did nothing for 10 years and then invested for 30 years.

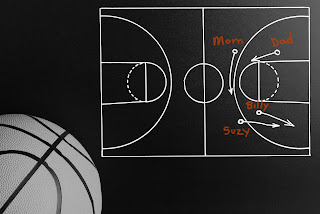

Guess who ended up in the worst shape financially?

Slow and steady wins the race. Right?

You can’t win if you give up a quarter of the way through like Quincy. Right?

And you can’t win if you miss the starting gun like Lyla, only jumping in after your opponents are already a quarter of the way there. Right?

Wrong. Despite the slow and steady saving for the entire race, Noah ends up the big loser. By a long shot.

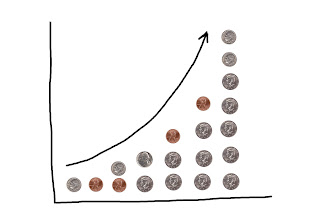

Why? Saving by itself just doesn’t cut it. The compound returns from investing long term in the stock market are like a turbo boost that gets stronger and stronger over time.

Not surprisingly, Chloe, with the turbo booster on the whole way, wins big.

But who wins between Quincy and Lyla? Remember, Quincy started right away, but quit after just 10 years. Lyla started 10 years late, but invested three times longer than Quincy. Seems like Lyla should win that one easily.

Nope. Quincy edges out Lyla.

If we assume, like today’s article does, that the money in the bank earned 2.25% per year (generous — must have been a pretty awesome CD!) and the index fund earned 6.5% per year (fairly conservative over 40 years), here are the final results:

|

Decade 1 |

Decade 2 |

Decade 3 |

Decade 4 |

Ending Amount |

| Chloe |

Invest |

Invest |

Invest |

Invest |

$1,870,480 |

| Quincy |

Invest |

|

|

|

$950,588 |

| Lyla |

|

Invest |

Invest |

Invest |

$919,892 |

| Noah |

Save |

Save |

Save |

Save |

$652,214 |

Wow. Chloe knocks it out of the park, Quincy and Lyla are neck and neck in the middle, and Noah is bringing up a distant rear.

Three things to teach your kids with this story:

- Invest your savings. Just look at the incredible power of compounding over time as the rate of return increases by even a small amount. Note: the savings here refers to what you’re able to accumulate after you’ve set aside an emergency fund in a safe, liquid bank account.

- Start investing early. Hint: convince your teen to open a Roth IRA with money from that first summer job plus some parental matching if possible. See here for more info.

- Invest in low cost index funds. Take it from Warren Buffett himself: “A low-cost index fund is the most sensible equity investment for the great majority of investors.”

May your kids invest in low cost index funds early and often... and live happily ever after.