If you’re among the growing ranks of parents using prepaid cards to put money safely in your kids’ hands, here are 24 tips for making the experience educational as well:

- Configure the card to avoid financial bullying.

- Teach your kid a simple secure PIN strategy.

- Challenge your kid to card fee bingo before first use.

- Use instant notifications to put some pain in cashless payment.

- Give your kid a prepaid card for online gaming, save $7,625.88.

- Use multiple cards to run your own private family banking system.

- Use a simple reimbursement process to make your kid aware of how expensive everyday life is.

- Use reimbursements to condition your kid to maintain a spending buffer.

- Turn the next treat outing into a mini budgeting lesson.

- Ding prepaid declines to train your kid to avoid future overdraft fees.

- Remind kids it’s 3 PIN strikes and your card’s out!!!

- Run your own family card reward program that racks up points for less spending.

- Play the Sweep-To-Savings Game with your kid.

- Show your kid how to avoid a ridiculous 14.2% tax on cash.

- Ding your kids for replacements to discourage cavalier card handling.

- Teach your kid to keep a backup stash of cash on hand (or under foot).

- Give your kid’s card a meaningful label to encourage the right habits.

- Give your kid’s allowance transfers a meaningful description to reinforce purpose.

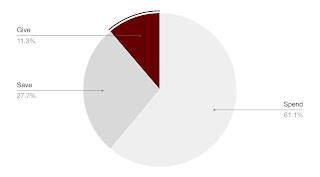

- Compartmentalize money for different purposes on separate cards.

- Set up text alerts that report the balance after every transaction to stay on budget and tip off fraud.

- Lock the card when it’s lost or stolen or just in need of a little financial time-out.

- Teach teens how to use prepaid cards at the pump without massive hassle.

- Make teens pass the No Decline Prepaid Challenge before opening a checking account.

- Use a hybrid card strategy to help teens build credit while staying on budget.

Got your own clever prepaid card hack for kids? Share it!

Like this tip? Get the next one in your inbox by subscribing here.

Want to turn these tips into action? Check out FamZoo.com.